Recruiting solely based on your instinct is an obsolete method now.

Data analytics (precisely–recruitment metrics) is the only way to go about it, thanks to the actionable insights that have been a complete game changer for the TA industry as a whole.

But there are a gazillion hiring metrics out there. How do you choose the ones you must track?

To make things a tad bit easier for you, we’ve conducted extensive research about the most crucial recruiting metrics every company must stay on top of, so you don’t have to.

What are recruiting metrics?

Recruiting metrics are data-driven indicators that help organizations assess the performance of their recruitment processes.

These metrics are essential for identifying areas of improvement, and ensuring that hiring practices are both efficient and effective.

Recruiting metrics measure various aspects of the hiring process, from the initial stages of candidate attraction to post-hire performance.

They help organizations make informed decisions, reduce hiring costs, and improve the overall quality of hires.

3 major categories of recruiting metrics

1. Operational metrics

Operational metrics are concerned with the efficiency of the recruitment process. They focus on the time, resources, and costs involved in hiring, offering a quantitative measure of how smoothly the recruitment activities are running.

They help organizations identify bottlenecks in the hiring process, such as prolonged time-to-fill can lead to operational disruptions, as vacant positions may slow down productivity and increase the workload on existing employees.

Additionally, excessive hiring costs can strain budgets, making it vital to monitor and manage these expenses effectively.

Using this category of metrics, recruiters can streamline processes, reduce delays, optimize resource allocation, and create a more agile and cost-effective hiring process.

They are essential for maintaining a swift and responsive recruitment process, ensuring that vacancies are filled promptly without compromising on quality.

2. Strategic metrics

Strategic metrics are designed to assess the effectiveness of recruitment strategies in meeting broader organizational goals. These metrics are not just about filling positions but about ensuring that the recruitment process contributes to the long-term success and competitiveness of the organization.

By measuring metrics like quality of hire and offer acceptance rates, organizations can ensure they are not just hiring quickly, but hiring the right talent that will drive the company forward. They provide insights into the return on investment (ROI) of recruitment activities, guiding strategic decisions.

For example, a high-quality hire not only fills an immediate need but also contributes to the company’s growth and innovation in the long run.

Strategic metrics help in identifying which recruitment channels and strategies are yielding the best results, allowing organizations to refine their approaches and maximize their impact.

Focusing on strategic metrics ensures that recruitment is not just a tactical function but a strategic asset.

This, in turn, improves the overall effectiveness of the recruitment process and ensures that resources are used efficiently.

3. Quality metrics

Quality metrics evaluate the long-term impact of recruitment decisions. These metrics go beyond the immediate outcomes of the hiring process to assess how well new hires integrate into the company and contribute to its success over time.

They are vital for understanding the sustainability of hiring practices and helping organizations measure the true value of their hires by assessing retention rates, employee performance, and cultural fit.

For example, a high candidate retention rate indicates that the recruitment process is effectively identifying candidates who are a good fit for the organization, both in terms of skills and cultural alignment.

Conversely, high turnover rates may signal issues with the recruitment process, such as poor job descriptions or inadequate onboarding practices.

By focusing on these metrics, companies can reduce turnover, improve employee satisfaction, and ensure that their recruitment processes are building a strong, cohesive workforce.

17 recruiting metrics to track for a bird’s eye view

1. Time-to-Fill

A SHRM study found that the average time-to-fill across industries is 42 days.

Time-to-fill measures the number of days it takes to fill a position from when a job is posted until an offer is accepted. This metric is crucial because prolonged vacancies can lead to productivity losses and increased costs.

Hence, the lesser, the better.

Kula can be a great choice if you’re willing to constantly monitor this metric.

From the moment a job is posted using Kula's 1-click job distribution feature, the platform begins collecting data on how long it takes to attract, screen, and hire a candidate.

It auto ‘magically’ logs timestamps for key milestones— such as when a job is posted, when applications are received, when interviews are scheduled, and when offers are extended and accepted.

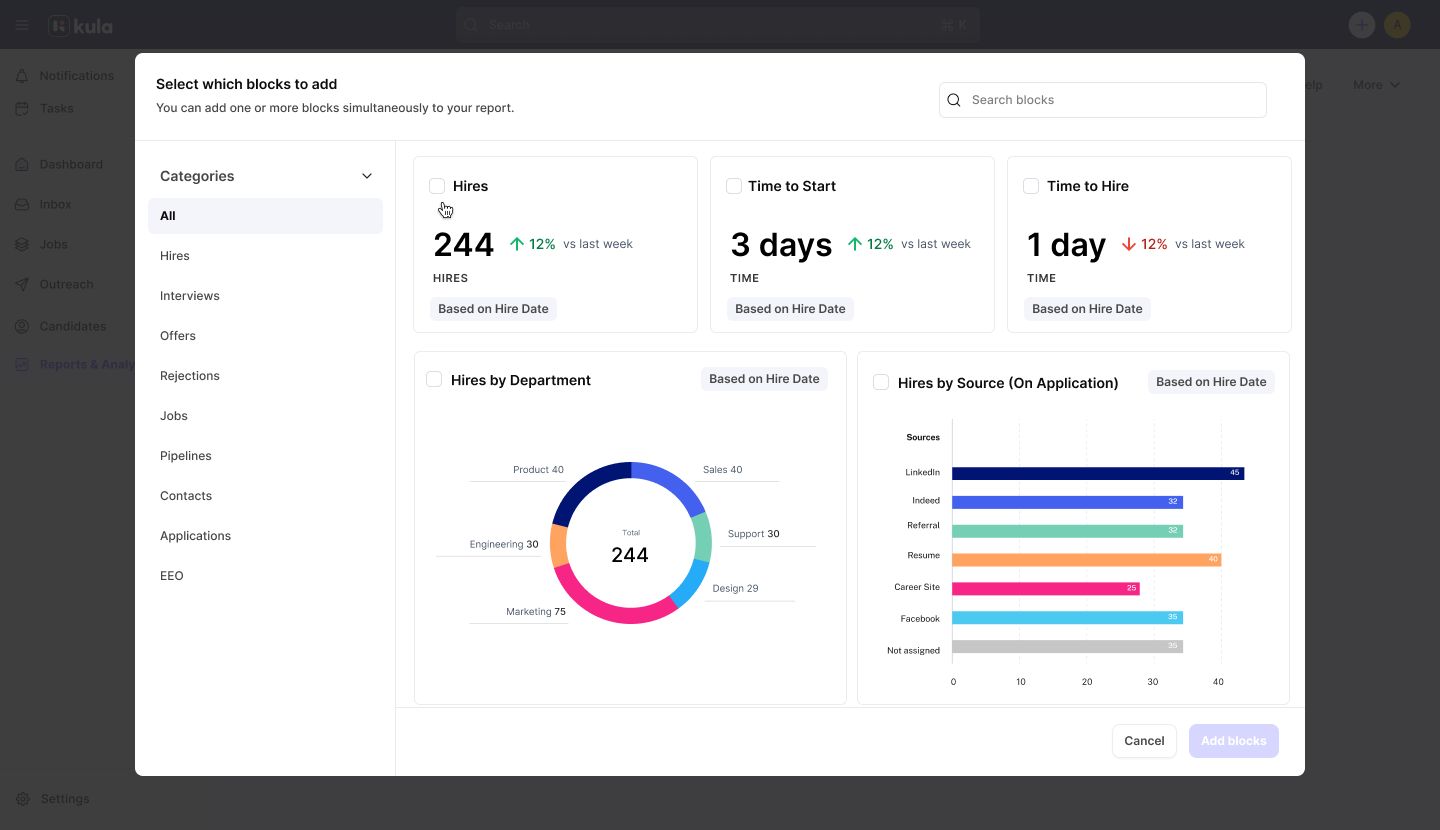

Thereon, all this data is aggregated in Kula’s analytics dashboard, allowing recruiters to see exactly how long each stage of the recruitment process takes.

Here, you get a detailed and comprehensive view to see through the cracks and fill them in right away.

2. Time-to-hire

Time-to-hire quantifies the time from when the top candidate applies to when they accept the job offer. Unlike time-to-fill, time-to-hire focuses on the efficiency of selecting and securing the best talent.

Research conducted by Robert Half suggests that 62% of job seekers lose interest in a role if they don’t hear back within two weeks.

So, you’re dealing with a highly time-sensitive candidate base here.

No room for careless delays.

Kula leverages its AI scoring feature, which evaluates and ranks candidates as they enter the pipeline to streamline the process.

The AI-driven approach ensures that only the most relevant candidate interactions are tracked, minimizing the time spent on less promising candidates.

Then, it tracks every interaction with candidates, including communication timestamps, interview scheduling, and offer negotiations, which is then compiled to give recruiters a clear view of exactly how long it takes to move a candidate through the hiring process.

3. Quality of hire

According to LinkedIn’s Global Recruiting Trends report, when it comes to evaluating performance evaluation, 39% of companies tend to put the quality of hire metric at the top.

But what is it?

Let’s say a company that hired a promising candidate who, on paper, seemed like the perfect fit. However, after a few months, it became clear that this employee needed help to meet expectations.

Despite their impressive resume, their performance lagged behind that of their peers, and they didn't quite mesh with the company culture.

This scenario is a clear indication of why measuring the quality of hire is essential.

Precisely, quality of hire is about assessing how well a new hire contributes to the organization after they’ve been brought on board.

Companies often assess the quality of hires using indicators such as job performance ratings, manager satisfaction, and the retention rate of new hires.

4. Cost-per-hire

Cost-per-hire is like the financial lens through which the entire recruitment process is viewed.

Consider a medium-sized enterprise that needed to rapidly expand its sales team. The company decided to launch a massive recruitment drive, advertising on multiple platforms, hiring a specialized recruitment agency, and even investing in an employee referral bonus program.

At the end of the hiring spree, the company filled all its open positions. But when the total expenses were calculated, they were surprised by the hefty bill.

Cost-per-hire encompasses all expenses incurred to fill a position, including job advertising, recruiter salaries, administrative costs, and even the cost of onboarding.

It’s a metric that directly impacts a company’s bottom line, making it essential to be monitored closely.

If cost-per-hire is too high, it could mean that resources are not being used efficiently, or that the recruitment process is overly complex or slow.

Tracking cost-per-hire allows you to make informed decisions about where to allocate your recruitment budget and how to optimize the hiring process to be both cost-effective and successful.

The SHRM reports that the average cost-per-hire is around $4,700.

5. Offer acceptance rate

The offer acceptance rate is the percentage of job offers that candidates accept. A low offer acceptance rate may indicate issues with compensation, job role clarity, or candidate experience.

Kula can help you measure the offer acceptance rate by tracking the number of offers extended versus the number of offers accepted. Every job offer sent out via the platform is recorded, along with the candidate’s response.

This data is then used to calculate the acceptance rate, with additional insights provided on factors influencing offer rejections, such as timing, compensation, or candidate engagement levels.

6. Sourcing channel effectiveness

Sourcing channel effectiveness is a metric that revolves around the success of different recruitment channels in attracting quality candidates. It is one of the best ways to optimize recruitment budgets and strategies based on authentic data.

Kula measures sourcing channel effectiveness by tracking the performance of different recruitment sources, such as job boards, social media, and employee referrals.

The platform centralizes data from these sources and allows recruiters to tag candidates by their origin.

Going forward, Kula analyzes the quality and quantity of candidates sourced from each channel, providing detailed reports that highlight which ones are yielding the best results.

The Kula Circles feature enhances this measurement by integrating employee networks and referral systems into the tracking process.

This allows recruiters to see not just where candidates are coming from, but also how effective each channel is at moving candidates through the pipeline to eventually hire.

7. Candidate experience metrics

Imagine a talented software engineer who just applied to a leading tech company.

From the outset, they were excited about the opportunity—the company had a stellar reputation and the job description seemed like a perfect match. But soon, their excitement began to wane.

The online application was cumbersome, requiring them to manually input details from their resume. Communication was way too on and off, leaving them in the dark for weeks after submitting their application.

Eventually, the engineer lost interest and accepted an offer elsewhere.

This scenario illustrates the importance of candidate experience metrics.

These metrics assess how candidates perceive the recruitment process, from the initial application to the final onboarding stages. A positive candidate experience is critical because it directly influences whether top talent will accept a job offer and how they perceive the company brand.

A CareerBuilder survey found that 78% of candidates say their experience during the hiring process is an indicator of how a company values its employees.

Companies track candidate experience through various methods, such as surveys, feedback forms, and analyzing the time it takes for candidates to move through different stages of the recruitment process.

Companies that prioritize a positive candidate experience by ensuring regular communication, providing clear timelines, and offering feedback regardless of the hiring decision–often see higher offer acceptance rates and build a strong employer brand that attracts future talent.

8. Recruitment funnel conversion rates

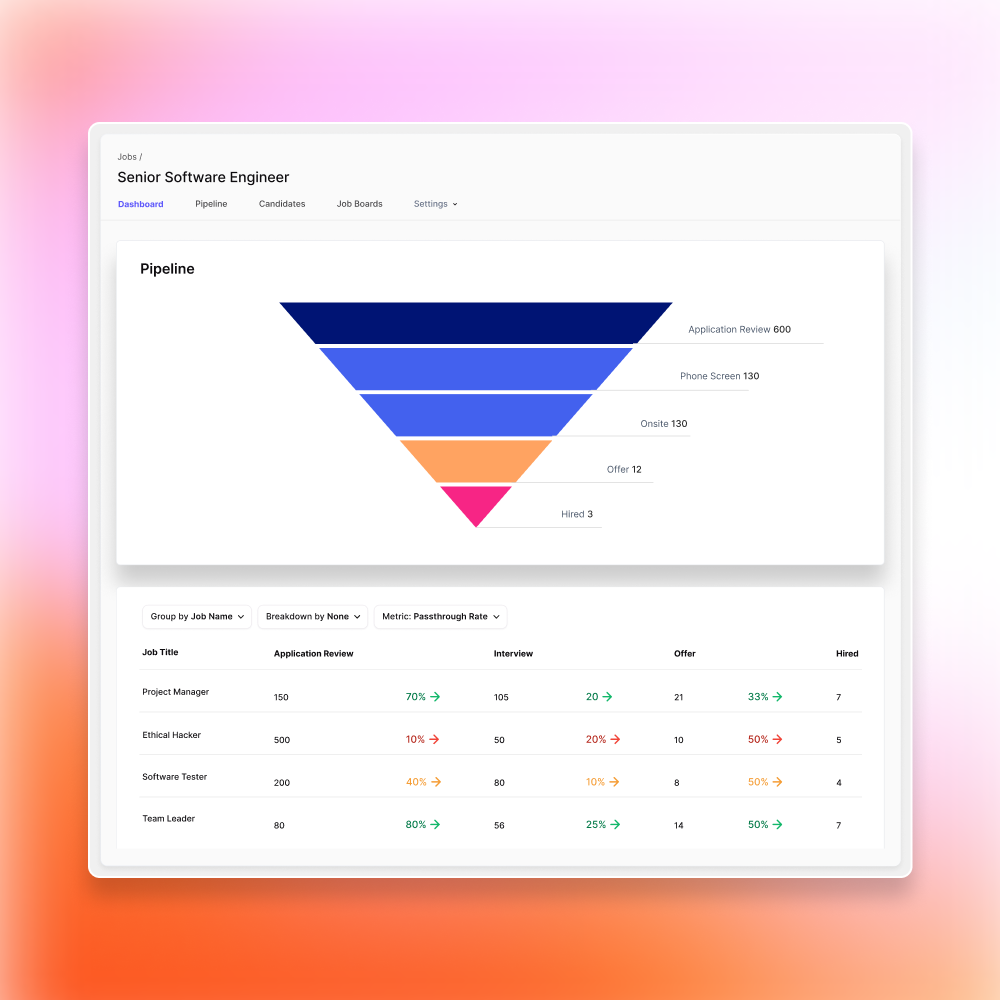

Recruitment funnel conversion rates track the percentage of candidates who move from one stage of the recruitment process to the next. This metric helps identify where candidates drop off and where improvements can be made.

Kula tracks recruitment funnel conversion rates by capturing data at each stage of the recruitment funnel—from initial contact to final hire.

The platform logs when candidates move from one stage to the next (e.g., from screening to interview), providing a clear picture of conversion rates at each step.

You can visualize this data in Kula’s analytics dashboard, where you can identify where candidates are dropping off and optimize those stages.

9. Diversity recruiting metrics

A global corporation aiming to enhance its innovation capabilities realizes that a more diverse workforce comprising individuals from different cultural backgrounds, genders, and perspectives can drive creativity and better problem-solving.

They set a goal to increase diversity within their ranks. But how do they measure success?

This is where diversity recruiting metrics come into play.

These metrics are essential for organizations committed to building an inclusive workforce. They help track the effectiveness of recruitment strategies in attracting diverse candidates and ensuring that hiring practices are fair and unbiased.

Diversity metrics might include the percentage of hires from underrepresented groups, the demographic breakdown of candidates at different stages of the hiring process, or the retention rates of diverse employees.

By closely monitoring these metrics, companies can identify and address potential biases in their recruitment processes.

For example, the data of a company shows a significant drop-off of female candidates after the technical interview stage.

Upon review, they discovered that the interview questions were inadvertently biased toward experiences more commonly held by male candidates.

Revising their interview process and incorporating more diverse perspectives into their question bank can significantly help them improve the balance of their hiring outcomes.

McKinsey’s research shows that companies in the top quartile for ethnic and cultural diversity on executive teams were 36% more likely to have above-average profitability.

Diversity recruiting metrics, therefore, not only help in tracking progress toward inclusivity goals but also in refining recruitment practices to ensure they are genuinely inclusive.

10. Candidate retention rate

Consider a company that prides itself on its rigorous recruitment process. They invest heavily in sourcing, interviewing, and onboarding new talent.

However, despite their efforts, they notice a worrying trend: many new hires leave within the first year.

Hence, the importance of tracking the candidate retention rate.

The candidate retention rate measures how many new hires stay with the company for a specified period, typically one year.

High retention rates suggest that the recruitment and onboarding processes are effective and that new hires are well-integrated into the company.

Conversely, low retention rates might indicate issues with job expectations, cultural fit, or onboarding procedures.

Retention is particularly important because the cost of turnover can be significant—both financially and in terms of productivity.

Gallup reports that the cost of replacing an employee can range from one-half to two times the employee's annual salary, making retention a key focus for cost management.

11. Hiring manager satisfaction

Let’s understand with the example of a large corporation that has just completed a major hiring drive.

Dozens of new employees have joined the company, filling critical roles across various departments.

However, when the HR team follows up with the hiring managers, they receive mixed feedback. Some managers are thrilled with their new hires, while others are frustrated, feeling that the candidates selected don’t fully meet their needs.

Exactly why we need hiring manager satisfaction as a metric.

Hiring manager satisfaction is a qualitative indicator that measures how content hiring managers are with the recruitment process and the candidates selected.

This key recruitment metric identifies whether your recruiting efforts align well with the needs and expectations of various departments within your organization.

By involving hiring managers more directly in the recruitment process, such as in crafting job descriptions and participating in early-stage interviews, you can improve the alignment between the candidates selected and the needs of the departments, leading to higher satisfaction levels.

Further, by regularly gauging hiring manager satisfaction, companies can ensure that their recruitment processes are meeting the needs of all stakeholders, leading to better hiring outcomes and more cohesive teams.

12. Employee referral program metrics

Employee referral program metrics track the success of employee referral programs, including the number of referrals, their quality, and their impact on retention rates.

These programs are often more effective than other recruitment methods.

Kula Circles tracks employee referral program metrics by monitoring the referral process from start to finish.

The platform registers each referral made by an employee, tracks the progress of referred candidates through the recruitment funnel, and measures the success rate compared to other sourcing channels.

This data is presented in dynamic recruitment metrics dashboards, allowing recruiters to see the ROI of their referral programs and make adjustments as needed.

13. Recruitment process efficiency

Imagine a manufacturing company facing delays in its production because key positions in the engineering team have been vacant for too long.

Despite numerous interviews, the recruitment process is moving at a snail’s pace, and the best candidates are slipping through the cracks, often accepting offers elsewhere.

The recruiters are frustrated, and so are the hiring managers, who are desperate to fill these critical roles.

A classic example of poor recruitment process efficiency.

Recruitment process efficiency measures how effectively the recruitment process is managed, from initial candidate engagement to the final hiring decision. It’s about ensuring that every step of the hiring process, from sourcing candidates to onboarding, is as streamlined and effective as possible.

An efficient recruitment process reduces the time-to-fill, enhances the candidate experience, and ensures that the best candidates are not lost to competitors.

Efficiency also extends to the alignment between recruitment teams and hiring managers.

When these groups work in sync, with clear communication and shared goals, the entire process becomes more efficient.

14. Candidate drop-off rate

The candidate drop-off rate measures the percentage of candidates who abandon the recruitment process before its completion. High drop-off rates can signal problems such as a cumbersome application process, poor communication, or a lack of candidate engagement.

The candidate drop-off rate measures the percentage of candidates who start but do not complete the application process.

A high drop-off rate often signals problems in the recruitment process, such as a complicated application system, poor communication, or even a lack of engagement from the recruiters.

For example, a global retail chain might find that candidates frequently abandon their applications at the stage where they’re required to input their employment history manually.

On investigation, the company discovers that many candidates find this step redundant, especially after uploading a detailed resume.

A report found that 60% of candidates drop off during the application process due to its complexity.

By simplifying the application form and ensuring that it only requires essential information, one can seamlessly reduce its candidate drop-off rate.

Another common cause of drop-offs is a lengthy hiring process.

If candidates don’t receive timely feedback or if they perceive that the process is dragging on, they may lose interest and pursue other opportunities.

Improving communication, providing clear timelines, and ensuring that the process moves at a steady pace can all help reduce drop-off rates.

15. Talent pool growth

For better understanding, let’s assume a small tech startup that’s planning to expand its operations.

The founders know that they’ll need to hire quickly as new projects come in, but they don’t have a ready pool of candidates to tap into. Every new hiring requirement feels like starting from scratch, leading to delays in filling positions and missed business opportunities.

This is where talent pool growth becomes a critical metric.

Talent pool growth refers to the expansion and management of a company’s database of potential candidates.

A robust talent pool is like having a reservoir of talent that recruiters can draw from when new positions open up, significantly speeding up the hiring process.

Additionally, talent pools are often segmented by skill set, industry experience, and other relevant criteria, allowing recruiters to quickly match candidates with the right roles.

For instance, a marketing firm might maintain a talent pool of content writers, social media experts, and digital marketers, regularly updating and engaging with them through newsletters, industry events, or even informal check-ins.

16. Recruitment marketing metrics

A survey reveals that 86% of job seekers use social media in their job search, highlighting the importance of a strong recruitment marketing strategy.

In a leading consumer goods company launching a new product line, the marketing team is in overdrive, crafting campaigns to attract customers. However, the company is in a severe need to ramp up its hiring to support this new venture.

Recruitment marketing metrics measure the effectiveness of an organization’s efforts to attract and engage candidates through various marketing channels. These channels include job boards, social media, career sites, and more.

Another aspect of recruitment marketing is employer branding.

How candidates perceive the company as a place to work can significantly influence their decision to apply.

Metrics like the number of visitors to the company’s career site, the time they spend on the site, and the actions they take (e.g., signing up for job alerts, and sharing job posts) all provide valuable insights into the effectiveness of the company’s recruitment marketing efforts.

The goal is to ensure that the company’s job postings reach the right audience and that the employer brand is communicated effectively.

Just as marketing is crucial to attracting customers, recruitment marketing metrics are essential for attracting top talent.

17. Predictive analytics in recruitment

A study found that companies using predictive analytics in HR are 50% more likely to improve their talent pipelines and reduce hiring costs.

Predictive analytics in recruitment involves using data, algorithms, and statistical models to forecast future hiring needs, candidate success, and other key outcomes.

It’s about leveraging historical data to make informed predictions about what’s likely to happen next in the recruitment market.

For instance, a company might use predictive analytics to identify the best times of year to recruit for certain roles based on past hiring trends.

Or they might analyze the characteristics of their most successful employees to create a predictive model that helps identify which candidates are most likely to thrive in similar roles.

Predictive analytics can also help in workforce planning.

So, in an organization, if the data suggests that a significant number of senior employees are likely to retire in the next two years, the company can start building a pipeline of potential replacements well in advance.

Similarly, predictive analytics can forecast which employees are at risk of leaving and develop strategies to retain them.

Final thoughts

When looking at it, there are numerous recruitment metrics that a company can track for an enhanced hiring process.

While the ones mentioned above are the pivotal and primary metrics that are non-negotiables in our list, your considerations and desired data might largely differ–hence, a difference in the recruitment metrics that hold the highest significance to your organization.

Thus, it’s advisable to do your own detailed research to ensure that the data you’re closely tracking truly aligns with the long-term goals of your organization and hiring team.